Technology. Has. Changed. Everything. There isn’t one aspect about commerce that hasn’t been revolutionized by tech –and that includes how the consumer engages with business before, during, and after the transaction.

Technology. Has. Changed. Everything. There isn’t one aspect about commerce that hasn’t been revolutionized by tech –and that includes how the consumer engages with business before, during, and after the transaction.

In the Mad Men days of advertising, attempts of getting leads were mostly a “spray and pray” method –posting an ad in magazines, billboards, TV and hoping that something would stick and convert.

Sounds archaic, doesn’t it?

The experience for the borrowers was just as bleak. Waiting for approval that moved at paint-drying speed was frustrating –through no fault of the LO! Things just moved slower in the pre-tech days.

But just like mortgage tech has revolutionized the process for the industry, it’s also altered what the consumer expects from their mortgage experience. We wrote about the mortgage experience and the digital mortgage tools that help to support a phenomenal experience in a previous post.

In this post, we’re going to start from the very beginning.

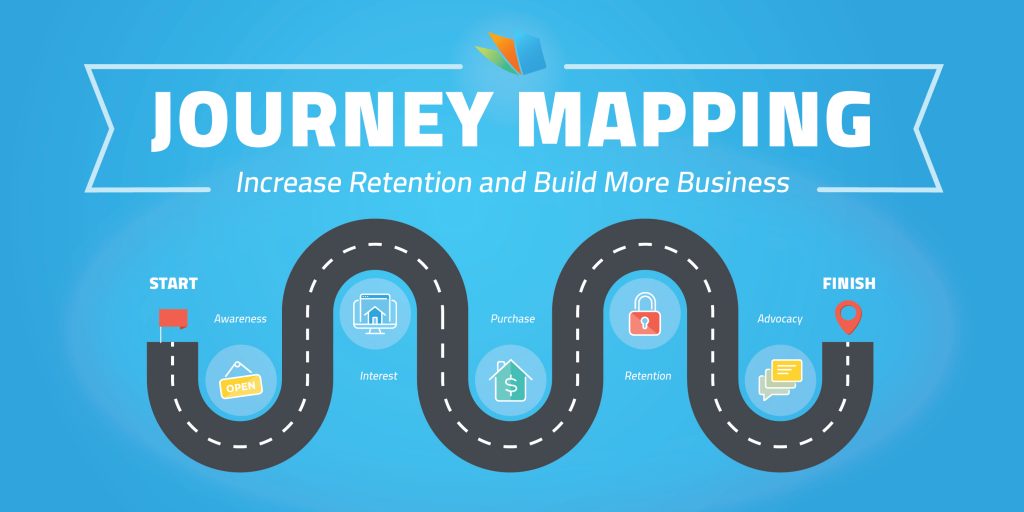

We’re giving you the framework for building a high-converting mortgage journey map –one that is unique to your business and all your prospects.

Does a mortgage journey map sound too “new age-y” for your lending business? Maybe this case study will change your mind? It demonstrated that a consumer journey not only increased revenue by 15% but is also lowered costs by 20%.

Put Borrower’s Motivation and Needs First

The first step is to consider the consumer’s perspective and make that your top priority. As counter-intuitive as this may seem, you need to put aside your agenda for selling more loans. Instead, you’re going to consider what your prospective borrower needs and how you can deliver it better than the competition.

If you answered the above question with, “my prospect needs a loan,” you’re missing the point.

Consumers don’t “want” a loan. They want the security, freedom, sense of accomplishment, investment in the future, etc. that a home loan affords.

Consumers don’t “want” a digital 1003. They want an agile, easy to understand, stress-free way to complete a loan application.

Sympathizing with your prospect’s needs helps you to create an irresistible mortgage journey that effortlessly guides them all the way through to funding.

Visualize The Mortgage Journey Map

Each map will be different. Not only are you servicing consumers with different loan needs, but each one will have a different “touchpoint” where they first engaged with you. It also varies as to how fast they move to fill out the application and upload supporting docs.

The easiest way, then, is to think of that initial touchpoint and where they would go from there. Was the first touchpoint a brief conversation where you handed your card? The next step in their journey may be to call you or visit your site.

If they visit your site, they may check out your reviews or your social media.

Usually, the initial touchpoint is online, such as from a Facebook mortgage ad or a local search on Google for mortgage services.

From that first interaction, your prospect will branch out and fill out your digital 1003, or browse your blog and subscribe, or download your mortgage app to explore your mortgage calculators.

You see where we’re going.

The borrower’s journey is unique depending on the initial touchpoint, where they engage next, and their motivation for a mortgage. Visualize different scenarios and optimize each with mortgage tech tools that meet their needs and motivations.

Consider Channels of Communication

A recent study by Boston Consulting Group found that borrowers considered communication with their loan originator as one of the highlights of their mortgage journey. With this in mind, consider:

- The various ways you can engage your prospect and borrower.

- At what point in the journey they may want to engage with you.

- What digital tools you need to be efficient and available to engage with your prospect or borrower.

For example, instant replies are a simple way to engage with your prospect. Facebook’s Messenger has a built-in capability and there are several third-party services that will send an instant reply whenever you get a new follower on Instagram or Twitter.

For the most powerful way to engage your borrower, you need a secure and ongoing chat that connects the borrower, loan originator, real estate agent, and any other stakeholder. Click to learn more about all the features of our new Loanzify POS system.

Be thoughtful about your communication. Find the sweet spot of your consumer’s preferred channel and the most efficient digital model for your business.

Looking for more efficiency? Read this article on how to reduce your loan processing costs and this article for the steps to digitizing your lending business.

Pingback: Mortgage Lead Generation: What No One Is Talking About | LenderHomePage